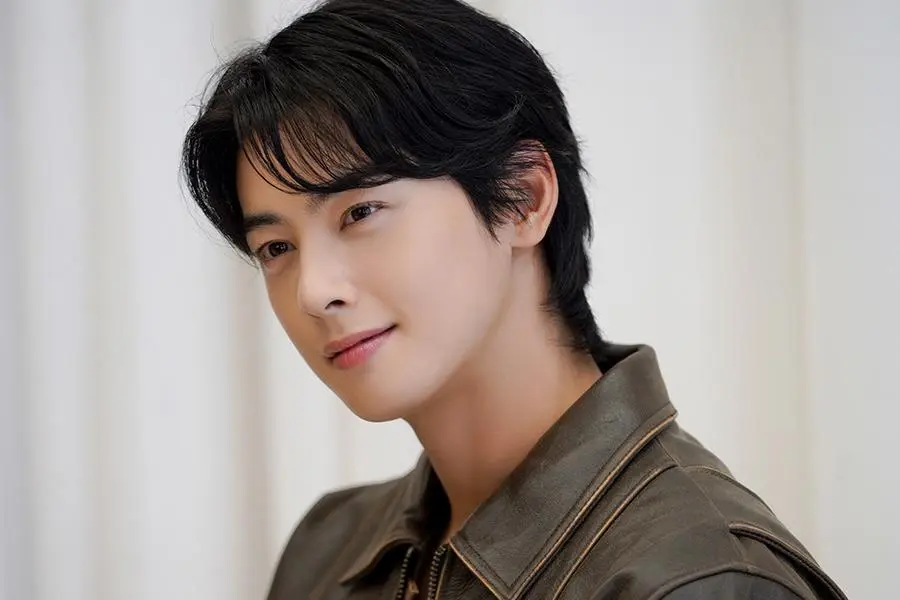

Fantagio has issued an official statement addressing recent reports alleging tax evasion by ASTRO member Cha Eun Woo. On January 22, a media outlet reported that Cha Eun Woo had been investigated last year by Investigation Bureau 4 of the Seoul Regional Tax Office on suspicion of tax evasion and that the National Tax Service had notified him of an additional tax assessment exceeding 20 billion won in income and related taxes.

According to the report, the issue centers on the structure of Cha Eun Woo’s income. Despite being signed to Fantagio, it was alleged that a separate family-run company—referred to as Corporation A and established by his mother—entered into a service agreement with the agency. Authorities reportedly questioned whether this arrangement was used to distribute income among Fantagio, Corporation A, and Cha Eun Woo himself in order to reduce tax liabilities.

Based on this assessment, the National Tax Service was said to have classified Corporation A as a so-called “paper company” that did not provide substantive services, concluding that more than 20 billion won in income tax had not been properly paid.

In response, Fantagio stated, “The key issue in this matter is whether the corporation established by Cha Eun Woo’s mother is subject to substantive taxation. At this time, nothing has been finally confirmed or officially notified, and we plan to actively clarify the matter through lawful procedures.” The agency added that both the artist and his tax representative will cooperate fully to ensure a swift resolution, while emphasizing that Cha Eun Woo will continue to faithfully fulfill his tax obligations as required by law.

Cha Eun Woo has been serving his mandatory military duty in the Army Military Band since July of last year and is scheduled to be discharged on January 27, 2027.